The Ultimate Guide to Vehicle Finance in South Africa

Introduction

The journey of purchasing a vehicle represents one of life's most significant financial decisions, and navigating the complex landscape of vehicle finance in South Africa requires careful consideration and thorough understanding. Whether you're a first-time buyer stepping into the automotive market or an experienced owner looking to upgrade your current vehicle, the financing process can seem daunting at first glance. However, with the right knowledge and preparation, you can transform this potentially overwhelming experience into an empowering journey toward vehicle ownership.

In this comprehensive guide, we'll explore every aspect of vehicle finance in South Africa, from understanding the fundamental principles that govern lending practices to mastering the nuances of different financing options. Our goal is to equip you with the knowledge and confidence needed to secure the most favourable financing terms for your specific situation, ultimately helping you make a decision that aligns with both your immediate needs and long-term financial goals.

The Crucial Role of Credit Scores in Vehicle Finance

Your credit score stands as the cornerstone of your vehicle financing journey, serving as a vital indicator of your creditworthiness to potential lenders. This three-digit number encapsulates your entire credit history, reflecting your past behaviour with credit and providing lenders with crucial insights into the level of risk they might assume by extending you a loan. Understanding the significance of your credit score and its impact on vehicle finance terms is essential for anyone entering the car buying process.

A strong credit score opens doors to preferential interest rates and more favourable loan terms, potentially saving you thousands of rand over the life of your vehicle loan. Financial institutions in South Africa typically use credit scores as their primary tool for assessing loan applications and determining interest rates. Those with higher credit scores often qualify for the most competitive rates, as they represent lower risk to lenders based on their demonstrated history of responsible credit management.

Regular monitoring of your credit report serves as a fundamental practice in maintaining and improving your creditworthiness. By reviewing your credit report at least quarterly, you can identify and address any errors or discrepancies that might negatively impact your score. These regular checks also provide opportunities to spot potential identity theft early and ensure that all information reflected in your credit report accurately represents your financial behaviour.

Building and maintaining a strong credit score requires consistent attention to various financial behaviours. Timely payment of bills, including existing credit obligations, utility payments, and other regular financial commitments, plays a crucial role in strengthening your credit profile. Additionally, managing your overall debt levels and maintaining a healthy debt-to-income ratio can significantly improve your creditworthiness in the eyes of potential lenders.

Understanding Interest Rate Structures

The concept of interest rates lies at the heart of vehicle finance, serving as the primary factor determining the total cost of your vehicle loan over time. South African financial institutions offer two main interest rate structures: fixed and variable rates, each presenting distinct advantages and considerations for different types of borrowers.

Fixed interest rates provide a sense of security and predictability in your financial planning. When you secure a vehicle loan with a fixed interest rate, your monthly repayment amount remains constant throughout the entire loan term, regardless of changes in the broader economic environment or the South African Reserve Bank's lending rates. This consistency makes budgeting straightforward and protects you from potential interest rate increases that could otherwise strain your monthly finances.

Variable interest rates, alternatively, fluctuate in response to changes in the prime lending rate. These rates typically start lower than fixed rates, making them initially attractive to many borrowers. During periods of declining interest rates, variable rate loans can result in significant savings as your monthly payments decrease in tandem with rate reductions. However, this advantage comes with an inherent risk: when interest rates rise, your monthly payments will increase accordingly, potentially creating financial pressure if not properly anticipated and planned for.

The Strategic Importance of Deposits

A substantial deposit represents one of the most powerful tools at your disposal when seeking vehicle finance. The impact of your initial deposit extends far beyond simply reducing the amount you need to borrow, influencing everything from your approval odds to the total cost of vehicle ownership over time.

Making a significant deposit, ideally twenty per cent or more of the vehicle's purchase price, demonstrates financial responsibility and commitment to potential lenders. This substantial initial investment reduces the lender's risk exposure, often resulting in more favourable interest rates and loan terms. Furthermore, a larger deposit provides immediate equity in your vehicle, helping to offset the rapid depreciation that typically occurs in the first few years of ownership.

From a practical standpoint, a larger deposit reduces your monthly financial obligations by lowering both the principal amount borrowed and the interest charged over the loan term. This reduction in monthly payments can provide greater financial flexibility and reduce the risk of payment difficulties during challenging economic times. Additionally, a substantial deposit can help you avoid becoming "upside down" on your loan, where you owe more than the vehicle's current market value.

Mastering the Application Process

The vehicle finance application process requires careful preparation and attention to detail to maximise your chances of approval and secure the most favourable terms possible. Understanding the requirements and expectations of different lenders can help you present your application in the strongest possible light.

Beginning with pre-approval represents a strategic approach to vehicle financing. This preliminary step involves submitting your financial information to potential lenders before selecting a specific vehicle. Pre-approval provides several advantages: it helps you understand your realistic budget parameters, strengthens your negotiating position with sellers, and reduces the risk of disappointment if financing falls through after you've emotionally committed to a particular vehicle.

Documentation plays a crucial role in the application process. Most South African lenders require proof of income, typically in the form of recent payslips or bank statements, proof of residence, and a valid South African ID or passport. Self-employed individuals may need to provide additional documentation, such as financial statements or tax returns, to demonstrate their income stability. Having these documents organised and readily available can significantly streamline the application process.

Understanding Total Cost of Ownership

The true cost of vehicle ownership extends well beyond the purchase price and monthly loan payments. A comprehensive understanding of all associated costs helps ensure that your vehicle finance decision remains sustainable over the long term.

Insurance represents a significant ongoing cost, with comprehensive cover typically required by finance providers. The type of vehicle, your driving history, and your chosen level of cover all influence insurance premiums. Some insurers offer preferential rates when insurance is arranged through specific finance providers, making it worthwhile to explore bundled options.

Fuel costs, maintenance requirements, and potential repairs should all factor into your vehicle ownership calculations. Different vehicles have varying fuel efficiency ratings and maintenance schedules, which can significantly impact your monthly operating costs. Additionally, some finance packages include maintenance plans or service contracts, which can help manage these costs more predictably.

Depreciation represents another crucial consideration in the total cost of ownership equation. Different vehicle makes and models depreciate at varying rates, affecting both your equity position and potential resale value. Understanding these factors helps inform both your initial vehicle selection and your financing strategy.

Navigating Balloon Payments and Residual Values

Balloon payment structures have become increasingly common in South African vehicle finance, offering lower monthly payments in exchange for a larger final payment at the end of the loan term. While these arrangements can make premium vehicles more accessible, they require careful consideration and planning.

A balloon payment, also known as a residual value, typically ranges from 20% to 40% of the vehicle's purchase price. This amount remains unpaid throughout the regular loan term, significantly reducing monthly payments but requiring settlement when the loan matures. Understanding the implications of balloon payments is crucial for making an informed financing decision.

The advantages of balloon payment structures include improved cash flow management through lower monthly payments and the ability to drive a more expensive vehicle than might otherwise be affordable. However, these benefits come with potential risks, including the challenge of saving for or refinancing the balloon payment when it becomes due.

Leveraging Technology in Vehicle Finance

Modern technology has transformed the vehicle finance landscape, providing tools and resources that empower buyers to make more informed decisions. Online loan calculators allow prospective buyers to experiment with different scenarios, adjusting variables such as loan terms, interest rates, and deposit amounts to understand their impact on monthly payments and total costs.

Comparison platforms have made it easier than ever to evaluate offers from multiple lenders simultaneously, promoting transparency and competition in the vehicle finance market. These platforms often provide detailed breakdowns of terms and conditions, helping buyers understand the nuances of different financing options.

Digital application processes have streamlined the financing journey, often allowing for preliminary approval within hours rather than days. However, the convenience of digital platforms should be balanced with careful attention to terms and conditions, ensuring that all aspects of the financing agreement are fully understood before proceeding.

Future Trends in Vehicle Finance

The vehicle finance industry continues to evolve, driven by technological innovation and changing consumer preferences. The growing popularity of electric vehicles introduces new considerations for finance providers and borrowers alike, potentially influencing loan terms and valuation models.

Flexible financing options, including subscription-based models and shared ownership arrangements, are emerging as alternatives to traditional vehicle finance. These innovative approaches reflect changing attitudes toward vehicle ownership and may influence the evolution of conventional finance products.

Understanding these trends can help inform your financing decisions, particularly if you're considering a longer-term loan or planning future vehicle purchases. The ability to anticipate and adapt to changes in the vehicle finance landscape can help ensure that your financing decisions remain advantageous over time.

Conclusion

Securing appropriate vehicle finance represents a significant milestone in your financial journey, requiring careful consideration of numerous factors and options. By understanding the role of credit scores, evaluating different lender types, and carefully considering interest rate structures and deposit strategies, you can approach the vehicle finance process with confidence and clarity.

Remember that vehicle finance decisions extend beyond securing the lowest possible monthly payment. A comprehensive approach that considers total cost of ownership, depreciation, and future financial implications will serve you better in the long run. Whether you're a first-time buyer or an experienced vehicle owner, taking time to understand and evaluate your financing options helps ensure that your vehicle purchase enhances rather than strains your financial wellbeing.

As you move forward with your vehicle finance journey, maintain focus on your long-term financial goals while addressing your immediate transportation needs. With proper preparation, research, and understanding of the various elements discussed in this guide, you're well-equipped to make informed decisions that align with your financial objectives and lifestyle requirements.

Discover More

The Lexus LX 2025 is set to revolutionise South Af...

Navigating vehicle finance in South Africa require...

Getting the best vehicle finance deal requires und...

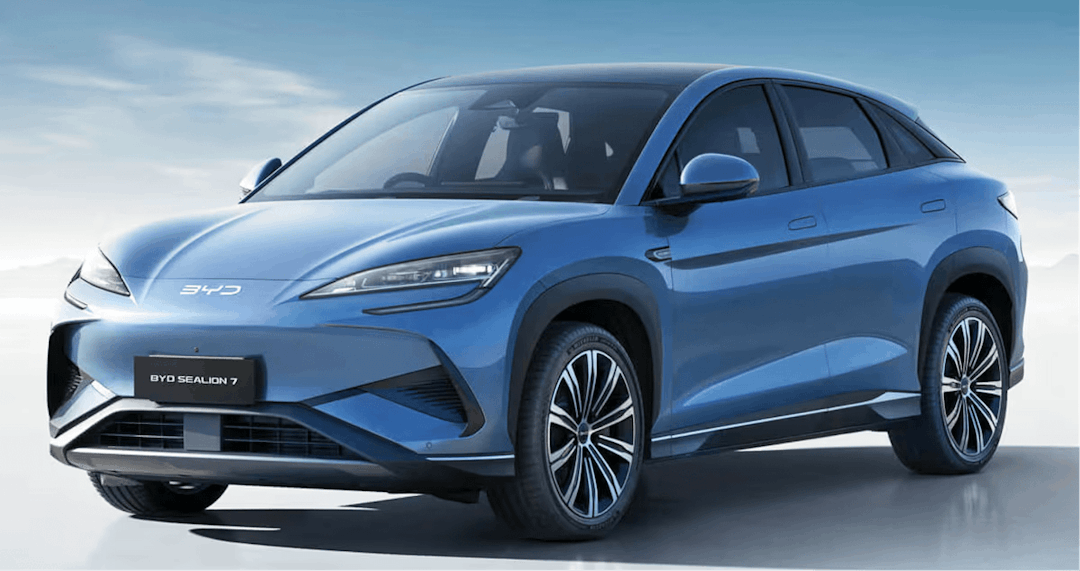

Discover how the BYD Sealion 7 EV is set to revolu...