The Smart Guide to Vehicle Finance: Best Deals 2025

Introduction

Vehicle finance is evolving rapidly with new lending technologies, changing economic conditions, and shifting consumer preferences. For most of us, understanding how to navigate this landscape effectively means the difference between a manageable financial commitment and a burdensome long-term obligation.

We'll explore the intricacies of securing the best vehicle finance deal in today's market. By examining how to prepare your application, navigate different lending options, and utilise modern tools and strategies, you'll be equipped to secure the most advantageous terms possible for your circumstances.

Understanding The Vehicle Finance Market

Our vehicle finance landscape has transformed significantly, shaped by technological advancement, economic shifts, and changing consumer needs. While traditional banking institutions continue to dominate the market, innovative fintech lenders have introduced new competition and lending approaches that benefit informed borrowers.

The Reserve Bank's monetary policy decisions have influenced lending rates significantly, creating a complex environment where understanding market dynamics becomes crucial for securing favourable terms. Current market conditions indicate a trend towards more personalised lending approaches, where multiple factors beyond traditional credit scores influence interest rate offerings.

Lenders now employ sophisticated risk assessment models that consider a broader range of financial indicators, including income stability, existing financial commitments, and overall debt management history. This evolution in lending criteria has created new opportunities for borrowers who understand how to position themselves effectively.

Maximising Your Credit Profile

Your credit score remains the foundation of securing competitive vehicle finance rates. Before approaching lenders, obtain your credit report and address any issues that might affect your application. Most major banks now offer free credit monitoring services through their banking apps, making it easier to track and improve your score.

Credit bureaus consider factors beyond traditional payment history, including cell phone contracts, retail accounts, and insurance payment records. Regular monitoring of your credit report helps identify areas for improvement and ensures accuracy. Even small errors can impact your credit score significantly, so reviewing your report quarterly is essential.

Building a strong credit profile takes time and consistent effort. Regular payments on existing credit facilities, maintaining low credit utilisation ratios, and avoiding multiple credit applications in short periods all contribute to a healthier credit score. Some credit-building strategies include:

Opening a credit card and paying the full balance monthly demonstrates responsible credit management. Maintaining long-term accounts shows stability to lenders. Keeping your credit utilisation below 30% of available credit indicates good financial management. Registering for credit-monitoring services helps track your progress and alerts you to potential issues.

Strategic Timing for Vehicle Finance

Market conditions significantly influence vehicle finance rates. The prime lending rate serves as a benchmark, with most vehicle loans priced at a margin above or below prime depending on your risk profile. Understanding these pricing mechanisms helps you recognise competitive offers when they arise.

Seasonal factors affect vehicle financing opportunities. Dealerships often offer preferential rates during specific periods:

Year-end promotions typically feature aggressive pricing and finance incentives as dealerships strive to meet annual targets. New model launches present opportunities for deals on previous models. Financial year-end periods often see banks offering competitive rates to meet lending targets. Holiday seasons frequently bring special finance packages and reduced deposit requirements.

Making Your Deposit Work Harder

While zero-deposit deals might seem attractive, providing a substantial deposit typically secures better interest rates and reduces monthly instalments. Current market trends show that deposits of 20% or more often qualify for preferential rates, potentially saving thousands over the loan term.

Consider creative approaches to building your deposit:

Use investments or savings that earn lower returns than vehicle finance rates. Combine trade-in value with additional cash for a larger total deposit. Explore family loan arrangements for deposit funding at favourable rates. Consider selling unused assets to boost your deposit amount.

A larger deposit not only reduces monthly payments but also provides protection against negative equity, particularly important given current vehicle depreciation rates. The initial depreciation impact becomes less significant with a substantial deposit, protecting your financial position if early settlement becomes necessary.

Mastering Insurance Requirements

Comprehensive insurance remains mandatory for financed vehicles. Modern insurance products often include additional benefits worth considering:

Guaranteed value cover protects against market value fluctuations. Credit shortfall cover bridges the gap between insurance payout and outstanding loan balance. Deposit protection reimburses your deposit if the vehicle is written off early in the loan term. Payment protection covers instalments during temporary income loss.

Many insurers now offer integrated finance and insurance packages. While these can provide value through simplified administration and potential cost savings, compare standalone options carefully. Some manufacturers offer subsidised insurance during the initial finance period, which can significantly reduce total monthly costs.

Advanced Negotiation Strategies

Effective negotiation extends beyond the vehicle's purchase price to include finance terms, insurance rates, and additional products. Understanding the total cost of ownership enables informed decisions about various finance options.

Some effective negotiation approaches include:

Request multiple quotes from different lenders before visiting dealerships. Use pre-approved finance offers as leverage in rate negotiations. Consider the timing of your purchase to align with dealership sales targets. Negotiate each aspect of the deal separately to maintain clarity on total costs.

Understanding Modern Finance Products

Contemporary vehicle finance offers various structures to suit different needs:

Standard instalment agreements provide predictable monthly payments. Balloon payment options reduce monthly instalments but require careful planning. Guaranteed future value programmes offer flexibility at the end of the term. Lease agreements might suit those preferring regular vehicle updates.

Each option carries distinct advantages and considerations. Standard instalments often result in the lowest total cost but higher monthly payments. Balloon payments reduce monthly commitments but require careful financial planning. Guaranteed future value programmes offer protection against market volatility but may restrict vehicle usage.

Understanding Different Lenders

Traditional banks remain major players in vehicle finance, each offering distinct advantages. Some focus on digital convenience, others on personalised service, and certain ones specialise in specific vehicle categories or buyer profiles.

Bank financing often provides competitive rates for existing customers, especially those with established transactional accounts. Many banks offer relationship-based pricing, where your existing portfolio of products can influence your vehicle finance rate.

Dealership finance divisions have evolved significantly, now offering sophisticated finance packages tailored to specific vehicle brands. These often include maintenance plans, insurance, and even fuel benefits integrated into a single monthly payment.

Independent financiers fill important market niches, particularly for buyers with unique circumstances. These lenders often show more flexibility in their assessment criteria, though rates might be higher than traditional banks.

Digital Tools and Applications

The finance application landscape has transformed dramatically with the introduction of sophisticated digital platforms. Most major banks now offer end-to-end digital applications, from initial quotes to final approval.

Mobile apps provide real-time tracking of application status, document uploads, and instant notifications. Some even offer virtual vehicle showrooms and augmented reality features to explore vehicles before visiting dealerships.

Digital comparison platforms have become invaluable tools for rate shopping. These platforms aggregate offers from multiple lenders, providing transparency in the market and helping identify the most competitive rates available.

Documentation Mastery

Preparing comprehensive documentation upfront streamlines the application process significantly. Beyond basic requirements, additional documents can strengthen your application:

Investment statements demonstrate financial stability. Business financials for self-employed applicants show income consistency. Asset registers indicate overall financial strength. Tax returns provide verification of declared income.

Digital document preparation has become increasingly important. Most lenders now accept digital submissions, making it crucial to have clear, high-quality scans of all required documents ready before applying.

Maintenance and Service Plans

Modern vehicles require specialised maintenance, making service plans an important consideration in finance decisions. Manufacturer service plans often provide the most comprehensive coverage but require careful evaluation of included services.

Third-party service plans have gained popularity, offering flexibility in service provider choice. These plans often cost less than manufacturer options but require due diligence regarding coverage and provider reliability.

Maintenance plan costs can significantly impact monthly budgets. Some plans allow for cost inclusion in the finance amount, spreading the expense over the loan term. Others require upfront payment or separate monthly instalments.

Strategic Buying Scenarios

First-time buyers face unique challenges but also enjoy specific opportunities. Many manufacturers offer graduate programmes with preferential rates and reduced deposit requirements. Building a relationship with a bank before applying can improve approval chances.

Upgrading an existing vehicle requires careful timing. Consider current vehicle market value, outstanding loan balance, and potential early settlement fees. Some lenders offer loyalty programmes with preferential rates for repeat customers.

Business vehicle finance presents different considerations. Tax implications, potential expense deductions, and business use requirements all influence the optimal finance structure.

Managing Running Costs

Fuel efficiency has become increasingly important given rising fuel costs. Consider how vehicle choice affects long-term running costs, including:

Regular maintenance requirements and costs. Insurance premium variations between models. Fuel consumption in typical driving conditions. Tyre replacement intervals and costs.

Some vehicles offer lower purchase prices but higher running costs. Others might cost more initially but prove more economical over time. Understanding these trade-offs helps make informed finance decisions.

Understanding Settlement Options

Early settlement options provide flexibility but require careful consideration. Most modern finance agreements allow early settlement without penalties, though terms vary between lenders.

Settlement quotes typically remain valid for limited periods, usually seven days. Understanding settlement calculation methods helps evaluate the benefits of early payment versus continuing regular instalments.

Risk Management

Gap insurance provides protection against outstanding loan amounts if your vehicle is written off. This coverage becomes particularly important with minimal deposits or balloon payment structures.

Credit life insurance, while mandatory, offers varying benefits between providers. Compare policy terms carefully, particularly regarding coverage exclusions and claim requirements.

Refinancing Opportunities

Market conditions change over time, potentially creating refinancing opportunities. Monitor interest rate movements and your credit profile improvements for potential savings through refinancing.

Some lenders offer automatic rate reviews for existing customers, adjusting rates based on payment history and market conditions. Building strong relationships with your finance provider can lead to preferential rates when refinancing.

Future Market Trends

The vehicle finance market continues evolving, with several emerging trends:

Integrated mobility solutions combining finance, maintenance, and insurance. Flexible ownership models allowing easier vehicle switching. Enhanced digital services for account management and service booking. Environmental considerations influencing finance products and rates.

Electric vehicle adoption introduces new financing considerations, including charging infrastructure costs and battery replacement provisions. Some lenders now offer specialised electric vehicle finance packages with extended terms and flexible structures.

Professional Support

Vehicle finance specialists can provide valuable insights and access to preferential rates. While their services might carry costs, potential savings through better rates often justify the expense.

Independent financial advisors can help evaluate different finance options objectively, particularly when considering complex structures like balloon payments or lease agreements.

Looking Ahead

The vehicle finance landscape continues evolving with new technologies and changing consumer preferences. Electric vehicles are gaining traction, with specialised finance products emerging for these vehicles. Consider how future trends might affect your vehicle's resale value and running costs.

Conclusion

Securing the best vehicle finance deal requires thorough preparation and understanding of current market conditions. By leveraging available tools, timing your application strategically, and negotiating from a position of strength, you can achieve terms that complement your financial goals.

Remember that vehicle finance represents a significant commitment. Take time to understand all aspects of your agreement, and don't hesitate to negotiate terms that work for your specific circumstances. With proper preparation and the insights provided in this guide, you're well-positioned to secure a finance deal that meets your needs while maintaining financial flexibility for the future.

Discover More

The Lexus LX 2025 is set to revolutionise South Af...

Navigating vehicle finance in South Africa require...

Getting the best vehicle finance deal requires und...

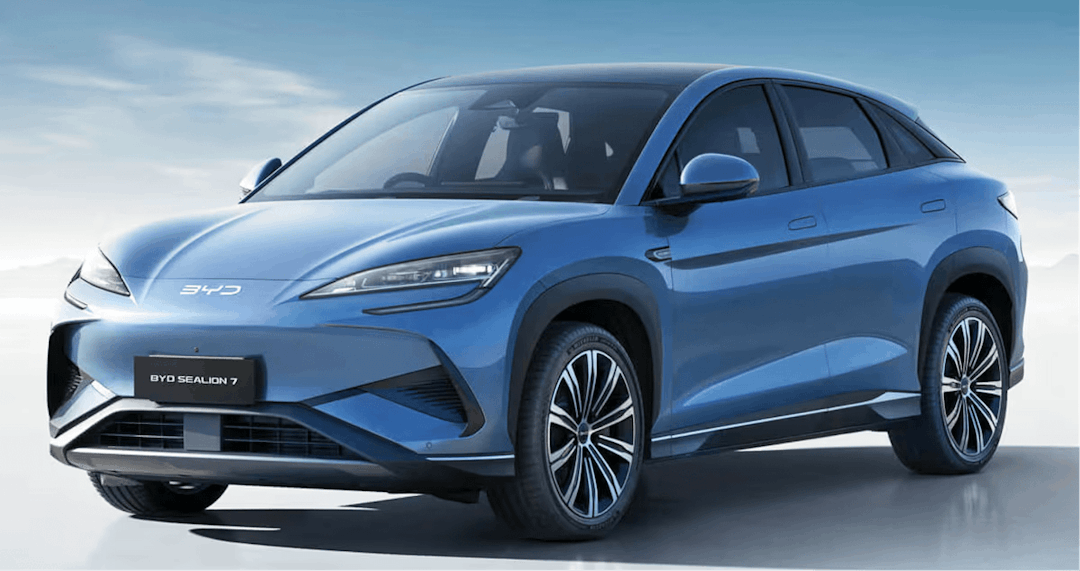

Discover how the BYD Sealion 7 EV is set to revolu...